How Much Money Is Your Subscription Business Losing with a Manual Billing Process?

Manual billing using legacy software might seem like a cheap strategy for subscription-based SMEs in their early stages; but this choice may be costing your business more than it saves and retarding your growth potential in more ways than one.

So how much money is your business really losing to the clunky, time-consuming and error prone manual processing of recurring billing and payments?

In a nutshell: A lot more than you think!

What is the Ultimate Cost of Using Manual Systems?

Why should businesses use an automated billing process when they can just get by with some freely available tools that allow manual processing?

After all, why spend more?

Interestingly, this question gets turned on its head upon a closer look at the real cost incurred to businesses through manual processing of bills payments and invoices. The bottom line clearly suggests that businesses investing in automated billing end up saving themselves from paying the much higher price of human error, high churn, revenue leakage, involuntary churn, employee burnout, an inability to develop a brand and the wastage of time. All these impediments make scaling up your subscription business practically impossible!

Here are some of the ways your subscription business is losing money to the manual processing of bills!

1. Human Error

Automating subscription management and recurring billing is a way for businesses to eliminate human errors from their accounting operations. On a very small scale, your business can check this error by streamlining workflows alone but as it scales up, so do the associated risks with manual operation.

A simple typo skewing numbers destined to be reported to investors and stakeholders can have far-reaching consequences on the reputation of your company.

Businesses also face a significant risk of fraudulent activity and account mishandling when billing is performed manually. This is apparent from the fact that 25% of accounts payable leaders say they struggle to mitigate increased fraud and compliance risks. Statistics also show that a company typically loses between 1-5% of its annual recurring revenue (ARR) to accounting fraud.

2. High Churn

The success of a subscription-based business hinges upon the satisfaction and loyalty of its customer base that actively maintains a long-term relationship with the enterprise. Customers losing interest or worse, trust, in your business leads to the highly undesirable result of cancelled subscriptions.

In the post-pandemic world of scattered human resource, 22% of accounts payable leaders say that their department is experiencing a big spike in supplier inquiries regarding the status of invoices and payments. When subscribers cannot rely on timely invoicing and predictable charges to their bank accounts, the inconvenience of having to contact customer support may push them to take their business elsewhere!

“It is not uncommon for 40% of churn to be caused by failed payments”

The repercussions of manual billing errors can also include scenarios like displeasing a customer due to accidental overcharge which promotes churn! A survey by Mailjet found that 93% of customers consider switching to a competitor after a single negative experience with transactional emails. It is not uncommon for 40% of churn to be caused by failed payments. This is why manual billing seriously threatens an enterprise looking to build strong foundations and foster sustainable growth.

Automation in the billing process ensures that the customer will receive timely invoices, automated renewal notifications, regular payments and smooth uninterrupted access without their lifting a finger during the subscription cycle.

3. Revenue Leakage

On the other side of losing subscribers due to missed payments, manual book-keeping can also result in revenue leakage from failing to charge active subscribers. This is unacceptable for a growing enterprise!

Over 90% of the customers to a subscription business are billed regularly at the same date each month. Having to draft and send the same invoice every time for each client is cumbersome, costly and time-consuming. This is particularly true in the case of a growing customer base! This produces an out-of-control revenue leakage, sure to hammer the nail in the coffin of your business’ growth potential!

4. Involuntary Churn

Involuntary churn refers to a phenomenon in which your subscribers do not voluntarily unsubscribe but are lost through repeatedly missed payments that go unnoticed. The only thing worse than consumers rapid unsubscribing, is the loss of subscribers through this involuntary churn that is caused by processing limitations. These include failed payments coupled with the absence of follow-up checks and cost you precious revenue that is entirely preventable by making the shift to automation in the billing process for subscription businesses.

The quality assurance offered by manual billing is only as good as your employee’s efficiency and attention-to-detail and even the best employees fail to cope with the sheer volume of subscriptions in a growing enterprise.

5. Loss of Productivity

56% accounting sector employees report spending more than 10 hours each week handling invoices and payments. In a world that is now shifting from automation into AI to further boost workflow efficiency and productivity, the wastage of time doing things the old-fashioned way is a mistake you won’t find smart business owners making!

6. Failure to Build a Brand Name

In the absence of reliable trust-worthy billing processes, your subscription business cannot hope to build a brand name which is only possible as the result of repeated smooth, error-free and dependable interactions with clientele. Without building a brand you cannot hope to promote subscription to your business and scale up your enterprise!

7. Employee Burnout

Manual billing also creates the in-house problem of a tedious work environment for your employees. According to the Institute of Finance and Management (IOFM), one-third of accounts payable practitioners are working increasingly longer hours, with 8% of them working an additional two hours or more per day. This puts a big question mark on the sustainability of an enterprise threatened by employee burnout!

Beth Kanter, a digital transformation specialist predicts,

“[An] increased use of RPA [robotic process automation] can mean an opportunity for upskilling and reskilling…that leads to not just a boost in productivity and a reduction in errors, but an overall greater employee experience.”

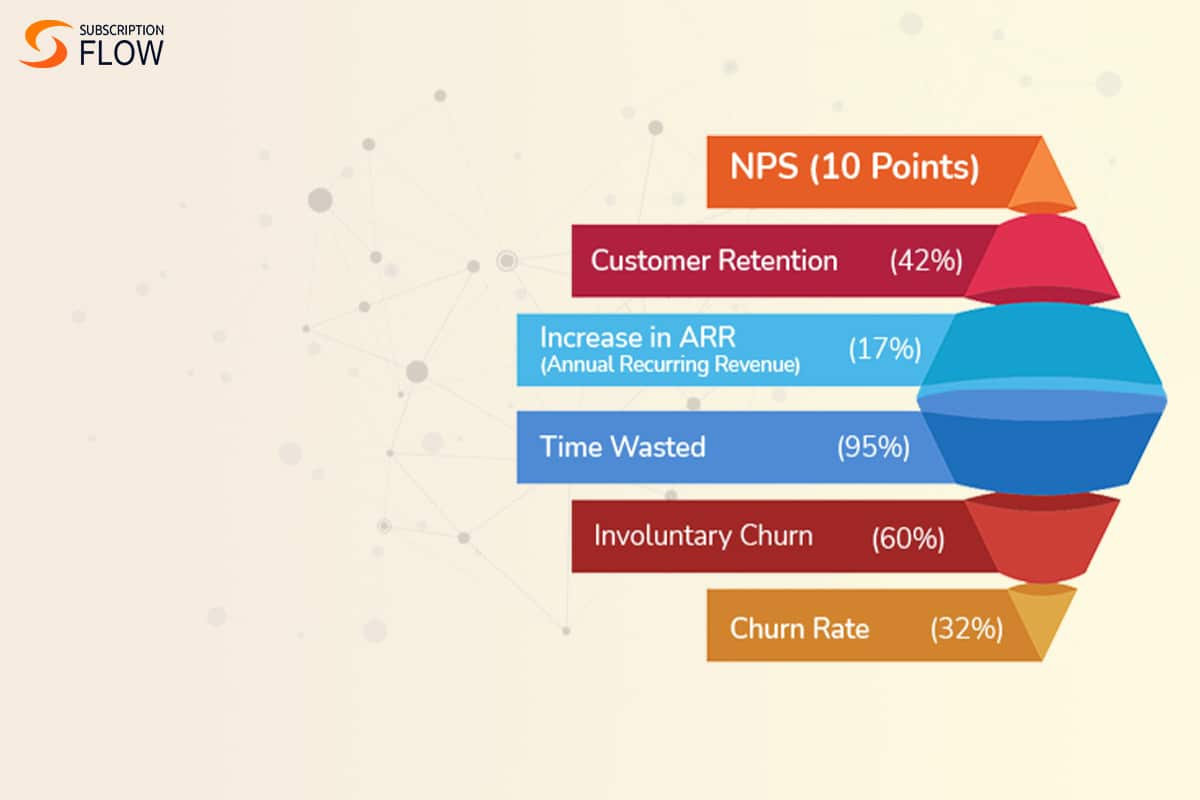

Automated subscription billing software promote efficiency, customer retention, revenue generation and productivity in happier employees while decreasing involuntary churn and revenue leakage! This builds your brand pushing all essential KPIs into the direction of business growth, which is why any business serious about its growth is making to shift to automated billing!