Payment Wars 1.1: Stripe vs Authorize.net

No matter the size of your business you need defined systems in place to properly run your business. Because of the pandemic, almost 80% of businesses shifted to work from home meaning the efficiency of the workers had to be twice as much.

Many businesses felt the need to have a proper payment gateway in place. Now we’ve covered what payment gateways and processing systems are in the previous article: Stripe vs PayPal. This is the continuation of the same series.

We are about to unveil who the best payment gateway in Stripe vs Authorize.net is. But first, let’s understand some things.

Why Go for A Payment Gateway?

You might be wondering why a payment gateway is important for your business. Well, e-payments were on the rise even before COVID hit and since 2020 they have skyrocketed. Online transactions, tap-to-pay transactions, mobile banking have crossed the 150% margin and are still on the rise. The traffic for these payments is insanely huge.

There is still some skepticism surrounding e-payments. But in this digital age, skepticism is not going to last very long. There have been significant milestones achieved and digital security has been at its best.

If you want to have an online presence, or go digital with your business, you need to have a secure yet good payment gateway in your basket. You need to accommodate your clients with all types of purchases they make and their preferred payment mode whether it be Venmo, Apple Pay, or a credit card transaction. Payment Gateways are going to make your life and business easier.

What are Stripe and Autorize.net?

Stripe and Authorize.net are payment gateways that also act as payment merchants. We have covered Stripe in the previous article but we’ll go through it again to get a thorough understanding of how both payment gateways differ and who can be the winner of Stripe vs Authorize.net 2022.

Let’s take a look at the basics of Stripe and Authorize.net.

Stripe

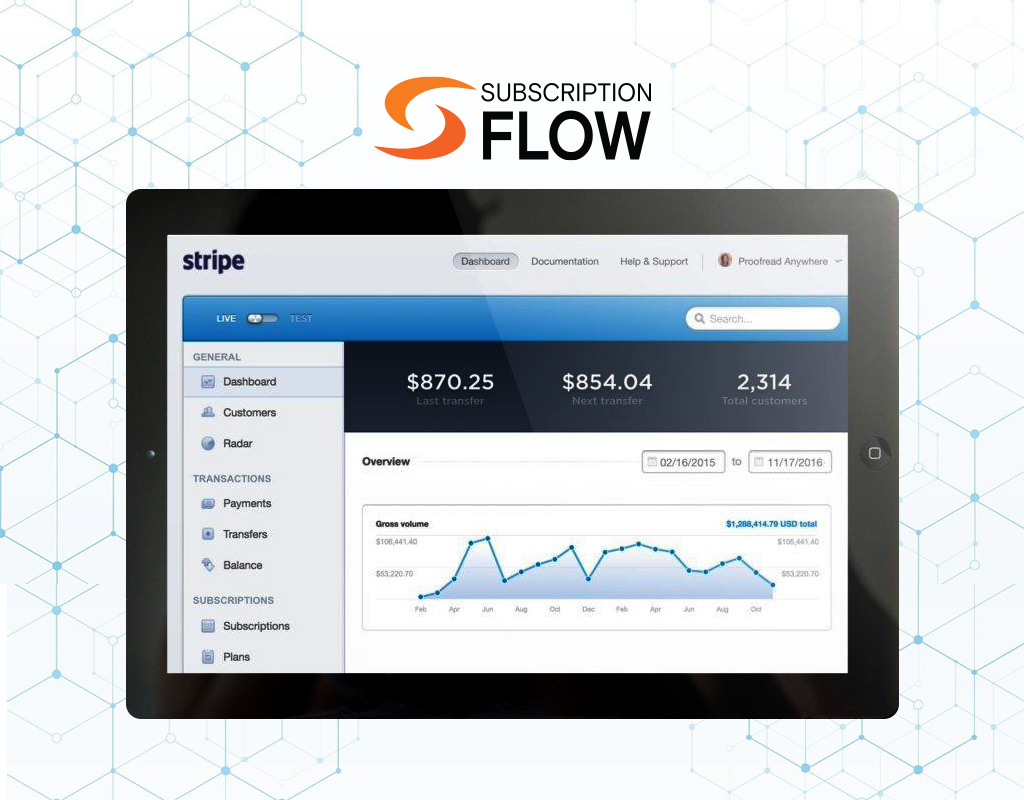

Stripe is one of the most popular and known payment gateways in the market. It has been famous in the e-commerce industry for a while now. Stripe is responsible for providing a secure, active and stable payment system to merchants. Founded in 2011, it has taken them years in stride and improved upon its services.

Available globally, it accepts multiple payment methods and currencies. Customers are also able to customize checkout. It offers a flat rate and no hidden charges. Stripe Terminal is available for those who do business in person.

The two primary products it offers are:

Stripe Connect

It is a customizable version for small businesses. Pre-made user interfaces are available but you can customize them according to your business needs. It works in more than 30 countries with over 135 currencies.

Stripe Checkout

It mostly handles mobile checkout with the desktop version available as well. Its supports over 25 languages.

Authorize.net

Authorize.net was founded in 1996 and acquired by Visa Inc. in 2010. The goal of Authorize.net was to expand into the e-commerce market, improve data security, and prevent online fraud. It offers multiple services including mobile payments, e-check, billing, and mobile card readers.

They accept multiple transactions including Visa, Visa Click to Pay, PayPal, AmEx, Mastercard, Discover, etc.

It supports currencies region-wise and integrates with big names like Magneto, Big Commerce, etc. They offer POS systems for virtual sales as well.

Authorize.net offers two plans for payment processing:

All-in-One

It is useful for small businesses who only want a payment gateway system and a merchant account with limited services and no multiple add-ons. It gives you the option to automate recurring billing. E-check payments processing costs extra.

Payment Gateway Only

Small businesses that already have merchant accounts can get a payment gateway facility as well. The payments are processed this way in batches from transactions lasting up to the previous 24 hours. Automated recurring billing is included in the plan while extra is charged for e-check payments processing.

Stripe vs Authorize.net: 5 Key Components to Know

Now we are getting to the good part. Let’s compare key components of both systems and figure out who will be able to cross the finish line. Hold on to your seats to find out the answer below!

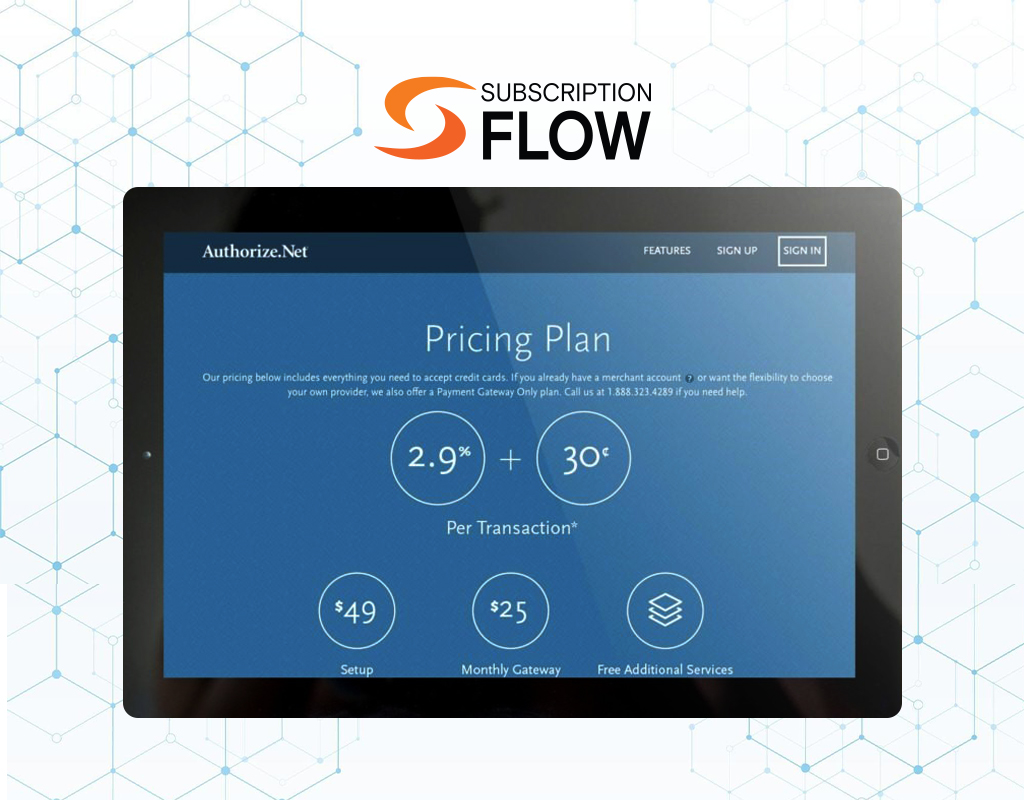

1. Pricing: Stripe Payments vs Authorize.net

Pricing is the most important factor while deciding on a payment system for your business. You need to make sure you are not overstepping your budget and are in line with your financial requirements.

Stripe has no monthly fees nor does it charge you while signing up. There is a standard transaction fee of 2.9% + $0.30 per online transaction. For in-person payments, the fee is 2.7% + 5c per transaction. There is a separate defined base charge of 3.9% for all international transactions including refunds, chargebacks, currency conversions, invoicing, billing, disputes.

Authorize.net charges you a monthly fee of $25. With a merchant account, you need to pay a fee of 2.9% + 30c per transaction. If you are only using a payment gateway there is a daily fee of 10c and also a 10c daily batch fee. ACH transactions cost extra and so does e-check processing.

Well, the winner here is stripe. It costs less than authorize.net and also has pretty standard charges. So, you will not be bending over backward to fulfill these costs.

2. Countries, Regions & Currencies

It’s important to know how much worth will the right payment gateway be bringing in your business. If you plan to expand overseas you need to have the system that is best suited for your needs.

Authorize.net can only accept transactions from merchants located in the USA, Canada, and Australia. It accepts 3 different currencies for Australian transactions, 2 for USA and Canada, and 8 currencies for UK and Europe.

Stripe is available in 47 countries and can process over 135 currencies.

Stripe is the clear winner as it is more diverse and will help you with that overseas expansion.

3. Supported Payment Methods

Stripe has two categories for payment methods: Universal and Local

Universal payment type is accepted throughout the world while local is for specified US, Chinese and European markets.

Stripe accepts the following universal and local payment types:

- Google Pay

- Apple Pay

- Alipay

- Microsoft Pay

- AmEx Checkout

- Visa Checkout

- Credit and/or debit cards

- WeChat Pay

- ACH transactions

- EPS

- FPX

- International cards and many more

Autorize.net only supports:

- Visa

- AmEx

- Discover

- Mastercard

- PayPal

- Apple Pay

- JCB

- Visa Click to Pay

- E-check payments

Need we say more? Stripe has clean swiped the payment method world with just a few strokes.

4. Core Features

Authorize.net offers a limited set of features. Most of the times companies run into authorize.net as the gateway for a payment processor for other companies but you can directly sign up with Authorize.net as well. The merchant account needs to be bought separately and isn’t in-house. It also offers a virtual POS that allows you to add card information manually. Automated recurring billing is also one of the main features that Authorize.net markets.

As advanced or additional features, Authorize.net includes free Advanced Fraud Detection Suite, e-check processing, and Customer Information Management.

Stripe has strong subscription tools. It allows advanced reporting through sigma, fraud monitoring tools, multi-currency conversions and displays, auto-updating of accounts, and mass payouts. Additionally, the atlas feature allows overseas businesses to incorporate in America. Moreover, more than 300 integrations are offered by Stripe.

Stripe has more advanced and widespread tools that make it a favorite.

5. Developer Tools

Stripe is known as a developer-friendly system and it has earned this reputation. If you are a novice, you can use stripe. If you are an expert, you can customize Stripe according to your needs. Stripe has detailed documentation and tutorials in place.

Following server-side languages is Stripe supported:

- Java

- .NET

- Go

- PHP

- JS

- Ruby

- Python

Authorize.net is not as developer-friendly as Stripe but has excellent online resources and options available to test out your code.

Following server-side languages are Authorize.net supported:

- Ruby

- C#

- Java

- Python

- PHP

Stripe is for sure the better choice for customization and developers.

The winner of Round 2 is….

Stripe is on a winning streak here. Stripe is best suited for small to medium businesses that want to expand overseas and require multiple add-ons. If you have a limited business and don’t wish to add more technicalities then you can opt for Authorize.Net

To get the best Stripe integration schedule a demo with SubscriptionFlow today!

frequently asked questions

Stripe is more useful who wants multiple add-ons and are looking to expand their business overseas as well. Authorize.net has limited capabilities and is useful for companies that have limited resources and don’t want multiple features.

Stripe is suitable for small to medium businesses with international customer base. Authorize.net is suitable for small businesses that prefer less customizations and limited features.