Payment Wars 1.0: Stripe vs PayPal

Are you in the market to shop for the answer to your payment processing system? Well, then you have come to the right place!

Any new business owners can get confused on which payment processor to opt for. They are so many options available that you seem to get lost in the array of information. So we have decided to make this easier for you. We are here with your go-to payment solution guide. Let’s have a detailed recount of who’s who? And more importantly which payment processor is going to change your business game?

What Is The Difference Between Payment Processing And Payment Gateways?

By definition,

Payment processors are companies that function as a mediator between merchants, customers, and financial institutions that process transactions. They are entities that synchronize non-cash transactions by validating all information and also distribute funds to the merchant, once a sale is completed.

Payment processing services include authorization, funding, and settling of a transaction.

On the other hand,

A payment gateway is a technology used by merchants to accept debit or credit card purchases from customers. The term includes not only the physical card-reading devices found in brick-and-mortar retail stores but also the payment processing portals found in online stores.

Let’s get a detailed overview of Stripe and PayPal and choose our winners based on the features, pricing, billing models, and a few more categories. Let the battle commence! But First,

What Are Stripe And PayPal?

If you are in the business market, you must have heard of Stripe and PayPal. These are the most common, popular, secure, and well-known payment gateways that provide payment services to e-commerce companies.

They are both equally reliable and have a queue of satisfied clients to prove their worth. They promise satisfaction, fulfill your payment system requirements and they deliver what they promise.

Here’s the basic difference between PayPal and Stripe

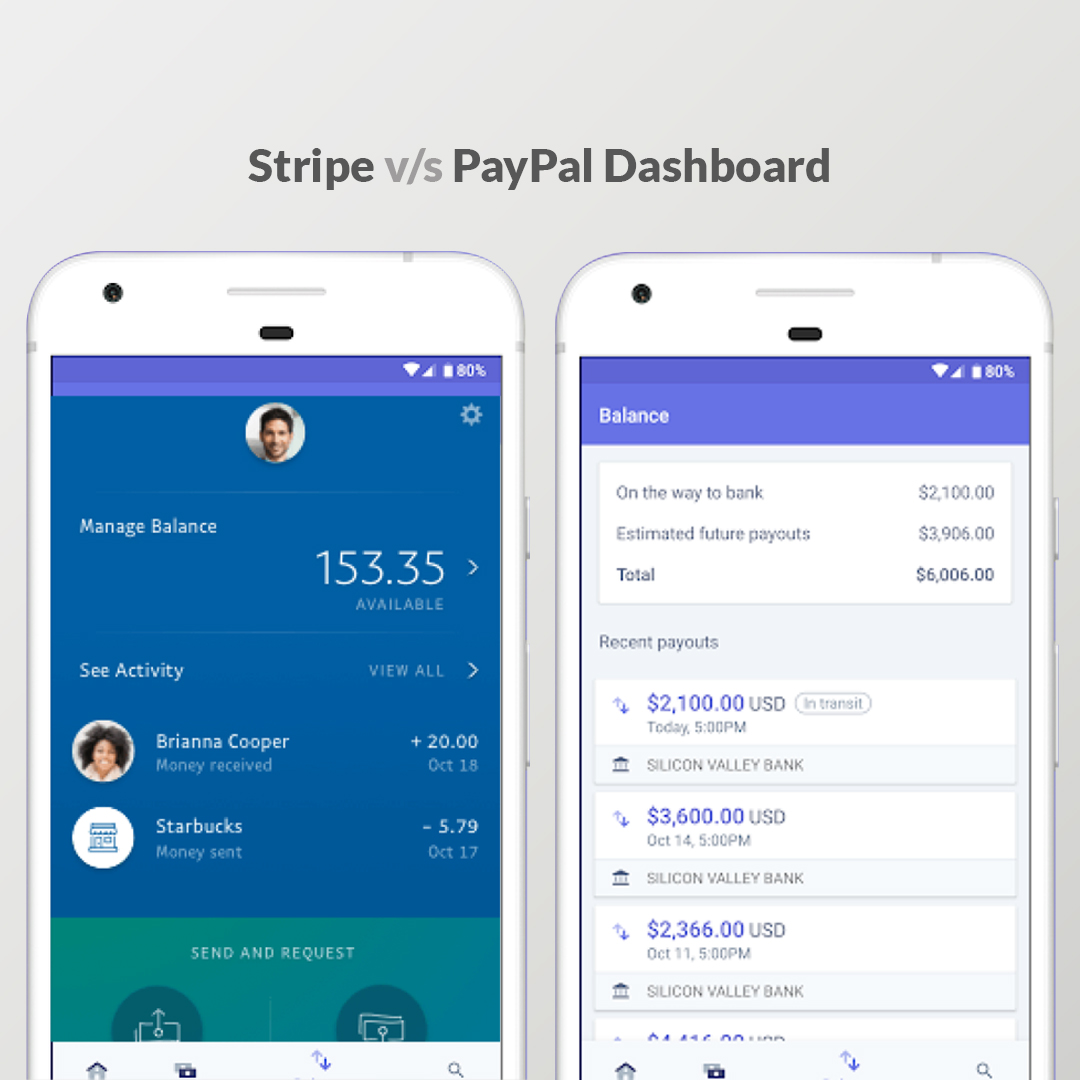

Stripe

Stripe is an online payment service founded in 2011. It was designed to help all companies (no matter the size) manage their finances and payment system. You can integrate Stripe in multiple ways because it was built with developers in mind.

It is available for global use and gives a fair advantage to businesses who want to expand overseas. Big e-commerce names such as Magneto, WooCommerce are in cohorts with Stripe. Currently, it is being used on over 140,000 websites.

Stripe offers two products:

Stripe Connect:

It offers a highly customizable payment solution that lets businesses control the payment process to the ‘T’ including signup, checkout, onboarding, and financial reporting. Multiple interface options are available, you can use a pre-made or customized interface using Stripe API.

Stripe Checkout:

This is majorly for mobile use and streamlines checkout. It is also available for desktop use. It’s a multilingual API with tax, discounts, and email receipts support.

Read More: PayPal vs. Stripe vs. Authorize.Net

PayPal

PayPal is over 2.5 decades old. It is available for both personal and business purposes. You can do all types of transactions (receiving, sending) and also buy and shop online as well as in-stores. It is also available for global use. Major companies including Hulu, Spotify Premium, and Wix lets customer subscribe using PayPal.

PayPal also offers two products:

PayPal Payments Standard:

This is the easiest version for business owners. If you don’t have any developer or coding experience you can simply copy-paste the code or install a plug-in catering to your cart needs, all accomplished within 15 minutes.

PayPal Payments Pro:

This is the customizable option. You can customize your checkout and get access to a virtual terminal. You’ll be able to accept phone payments as well.

Stripe vs PayPal: 5 Key Components To Know

Let’s compare Stripe with PayPal and once and for all conclude which system is going to be the winner for your business needs. After the comparison, you will have a better understanding of each platform and will narrow down the components you want.

-

Pricing Structures

Let’s start with the most obvious subject. Payment Processing Fee is almost always a make or break for any business. If you want to buy software or service, you’ll be very mindful of the amount you have to spend on it. For payment processing, you would lean more towards a low transaction fee.

On the good side of the news, basic plans for both Stripe and PayPal are free. There are no hidden charges, no upfront charges, you only need to enter your account details and you are in. But there is a catch. Once you start payment collection there are certain fee structures in place.

The basic fee per transaction is 2.9% + 30c per transaction.

PayPal structures the fees based on:

- Transaction region (the U.S or international)

- Payment scale (large or micro)

- Payment Version (mobile, online, or in-store)

- Checkout category (hosted, embedded, customized)

- Currency conversion

- Chargebacks or Refunds

- Recurring Billing

- AmEx Payments

- Mobile card reader transactions

Stripe has more simple structures in place. You are charged a 3.9% base fee per international transaction as well as refunds, chargebacks, currency conversions, invoicing services, and disputes.

The clear winner here is Stripe! The fee structures are simple and mostly the same for multiple categories of transactions. You won’t have to worry about how your next purchase is going to be charged. While with PayPal, you’ll need to be mindful of the service you are accosting.

-

Acceptable Payment And Payment Types

Acceptable PayPal payment methods are as follows:

- PayPal Credit, Cash and Cash Plus

- Credit and/or Debit cards

- Phone payments

Not all payment types are readily available. It all depends on the payment solution or tier you have chosen as your go-to solution.

On the other hand, acceptable Stripe payment methods are as follows:

- Google Pay

- Apple Pay

- AliPay

- AmEx Checkout

- Visa Checkout

- Credit and/or debit cards

- WeChat Pay

- International cards and many more

Need we say more? The clear and winning by a large margin here is Stripe. It’s convenient, appealing, and will help you in payment collection from around the world.

-

Currencies, Countries, and Regions

Now, when you want to select a payment solution you need to take a closer look at how far spread it is. Can you or can you not conduct business overseas and accept multiple currency payments and will help expand your business in the coming time. This is where both Stripe and PayPal opted for different paths.

PayPal accepts payments from users in over 200 countries and can process up to 25 currencies while Stripe can process more than 135 currencies but is only available in 47 countries.

The winner of this will depend on what you are looking for, whether you want to be available in more countries and use specific currency options or you are into multiple currency accounts.

-

Integrations (Third-Party)

If you need a simple payment processing solution to connect with third-party tools and platforms then you need to get PayPal minimal integration. This integration is already in cahoots with WooCommerec, E-commerce, CRM, etc.

Stripe has reached a whole other level with integrations. It has categories dedicated to CRM, email and referral marketing, inventory, accounts, recurring payments, e-com, and so many more.

You might also be able to integrate Stripe with platforms already under your use.

In clear words, if you want to live a healthier, easier, and more extensive business life, go for Stripe.

-

Security Payment Card Industry (PCI) Compliance

Security is a feature that you can never ever compromise on. If you are trusting a payment solution, you will trust them to be ultra-secure, encrypted, and fraud-proof. They need to efficiently tackle all levels of e-commerce security.

It will feel good to hear, that both Stripe and PayPal are PCI compliant. Users are redirected to the PayPal website to complete transactions, without any additional fees. The same is the case with Stripe. It handles all PCI-compliant issues and does not charge you even an extra dime.

Both Stripe and PayPal are equal winners in this regard. If they were lacking in security or were not PCI compliant, they would not have had the user base they have.

The winner is….

Well, clearly Stripe has won this round by a wider margin. Although PayPal has been in the game for a decade longer than Stripe, it all comes down to what you are looking for in your business. Just consider these basic key points before making an informed decision and also remember Stripe is more suited for medium-sized businesses while PayPal is better suited for small-scale businesses, startups, and freelancers.

frequently asked questions

Stripe is being used on more than 140,000 websites at the moment whereas PayPal is being used by more than 400,000 websites.

Both Stripe and PayPal have a standard charge of 2.9% + 30c per transaction. Both have different fee structure for their Pro plan. There is no upfront or hidden charges.